BOOTCAMP Credit Risk Modelling

CREDIT RISK MODELLING [225+ hours]

EXCEL + PYTHON

Basic Understanding

| Sn | Topics |

|---|---|

| 01 | Understanding Loan Lifecycle |

| 02 | Scorecards vs Basel vs IFRS9 vs CCAR models |

| 03 | Excel hands-on – Data Preparation for Model development |

Scorecards

| 1. | Application Scorecard vs Behavioural Scorecard |

| 2. | Understanding Bad definition |

| 3. | Excel hands-on - Roll Rate Analysis (to incorporate bad flag) on Fannie Mae Mortgage data |

| 4. | Understanding concepts of Snapshot, Observation Period & Performance Period |

| 5. | Excel hands-on - Seasoning analysis to identify Performance Window |

| 6. | Thinking beyond Statistics - Policy rules, Overrides, Reject Inferencing |

| 7. | Excel and Python hands-on – Building Application Scorecards using Logistic Regression |

| 8. | Excel and Python hands-on – Building Behavioural Scorecards using Logistic Regression |

Loss Modelling

| 1. | Excel hands-on - Modelling Losses through Vintage analysis |

| 2. | Excel hands-on – Modelling Losses using Flow Rate Approach |

Modelling Probability of Default

| 01 | Excel hands-on -Calculating PD using Logistic Regression |

| 02 | Calculating PD using Machine Learning Techniques |

| 03 | PD segmentation using Decision trees |

Modelling Loss given Default

| 01 | Calculating workout LGD (Excel) |

| 02 | Tobit & Beta Regression for LGD Modelling (Excel) |

| 03 | Tobit & Beta Regression for LGD Modelling (Excel) |

| 04 | Incomplete workout approach (Excel) |

Modelling Exposure at Default

| 01 | Modelling EAD using CCF (Excel) |

| 02 | CCF calculation using Fixed & Variable Horizon, Cohort approach (Excel) |

| 03 | CCF Regression (Excel) |

Cure Modelling

| 01 | Instant Cure vs Probationary Cure (Model design) |

| 02 | Loss given Cure modelling |

Basel Capital Charge

| 01 | RWA & Capital Adequacy Ratio calculations (Excel) |

| 02 | Using Vasicek formula to convert TTC PD to Worst Case PD |

| 03 | Calculating Capital as per Basel IRB Approach (Excel and Python) |

IFRS 9 Introduction

| 01 | TTC PD in Basel vs PIT PD in IFRS |

| 02 | 12 months PD calculation vs lifetime PD calculation |

| 03 | Understanding Concepts of Staging – Stage 1| Stage 2 | Stage 3 |

IFRS 9 PD Calculation

| 01 | Understanding Conditional PD Vs Unconditional PD |

| 02 | Excel and Python hands-on – Converting TTC PD to PIT PD using Z score |

| 03 | Excel and Python hands-on – Converting TTC PD to PIT PD using Log Odds shift |

| 04 | Excel and Python hands-on – Converting TTC PD to PIT PD using Scalar approach |

| 05 | Calibration & Smoothening techniques (Excel) |

CECL techniques

| 01 | Discrete Time Hazard Models (Excel) |

| 02 | Snapshot/Open Pool Method |

| 03 | WARM Model (Excel) |

| 04 | Vintage analysis (Excel) |

Actuarial Credit Risk Models

| 01 | Survival analysis (Excel) |

| 02 | Lee Carter Model (Excel) |

| 03 | Age Period Cohort Analysis (Excel) |

APC Extensions

| 01 | Validating APC - Alternating Vintage Diagrams, Moran's D (Excel) |

| 02 | Bayesian APC (Excel) |

| 03 | Quantifying Adverse Selection by Vintage (Excel) |

| 04 | Adverse Selection through Fixed and Random effects (Excel) |

IFRS 9 LGD & EAD Calculation

| 01 | PIT forward looking term structure of LGD as a function of Collateral value (Excel) |

| 02 | PIT forward looking term structure of LGD using Regression (Excel) |

| 03 | Calculating PIT LGD using Jacob Frye model (Excel) |

| 04 | CCF Term structure using Regression (Excel) |

IFRS 9 Wholesale Models

| 01 | Understanding Transition Matrices |

| 02 | Building Transition Matrix using Cohort Approach (Excel and Python) |

| 03 | Building Transition Matrix using Duration Approach (Excel and Python) |

| 04 | Converting TTC Transition Matrix to PIT Transition matrix (Excel and Python) |

| 05 | Validating Transition Matrices (Excel) |

Low Default Portfolios

| 01 | Bayesian approach to handle LDP (Excel) |

| 02 | Pluto Tasche Approach (Excel) |

| 03 | Van Der Burgt Method (Excel) |

| 04 | QMM Method (Excel) |

Stress Testing

| 01 | Top Down vs Bottom Up stress Testing (Excel) |

| 02 | Understandings CCAR vs DFAST requirements |

| 03 | Excel hands-on – Modelling ARIMA & ARIMAX |

| 04 | Excel and Python hands-on – Building CCAR models using multiple regression & time series models |

| 07 | Excel hands-on – Perform 9 quarter In Sample & Out of Sample Backtesting |

| 08 | Backtesting & Benchmarking |

Model Validation

| 01 | Evaluating Discriminatory Power Of Model (Excel) |

| 02 | Evaluating Accuracy of Model and Calibration (Excel) |

| 03 | Performing Stability analysis (Excel) |

| 04 | Margin of Conservatism (Excel) |

| 05 | Validating Wholesale Models (Excel) |

| 06 | Validating Stress Testing Models (Excel) |

Pricing Loans

| 01 | Optimizing Yields using Solver (Excel) |

| 02 | RAROC based pricing (Excel) |

Corporate Credit Models

| 01 | Merton & KMV Models (Excel) |

| 02 | Credit Plus Models (Excel) |

| 03 | Credit Portfolio View (Excel) |

| 04 | Credit Metrics Model (Excel) |

We provide Dedicated 60 hrs of Python Modelling sessions specifically for credit risk models apart from the above lectures.

ABOUT THE TRAINER

Karan is a highly skilled & knowledgeable Corporate trainer with 5+ years of total work experience spanning across Financial Modelling & Data Analytics. Known for having a knack for problem solving, thought leadership, highly analytical mindset, intrapreneurship, solid fundamentals & learning aptitude. Spearheaded several solution accelerators and spreadsheet based prototypes in Risk and Analytics space.

Q1. What are the pre-requisites to this course?

Ans. 1. Anyone with finance background like having studied some level of CFA FRM or actuaries can join this program.

Q2. Can I join this program if I have little stats and excel background ?

Ans.2. Some basic knowledge of statistics and excel is must to attend this program.

Q3. This course covers only theory or models as well?

Ans 3. This course is quite long & comprehensive only because we have covered the entire curriculum in 3 parts – theory discussion, visualisations in excel, practical implementation through hands-on session in excel.

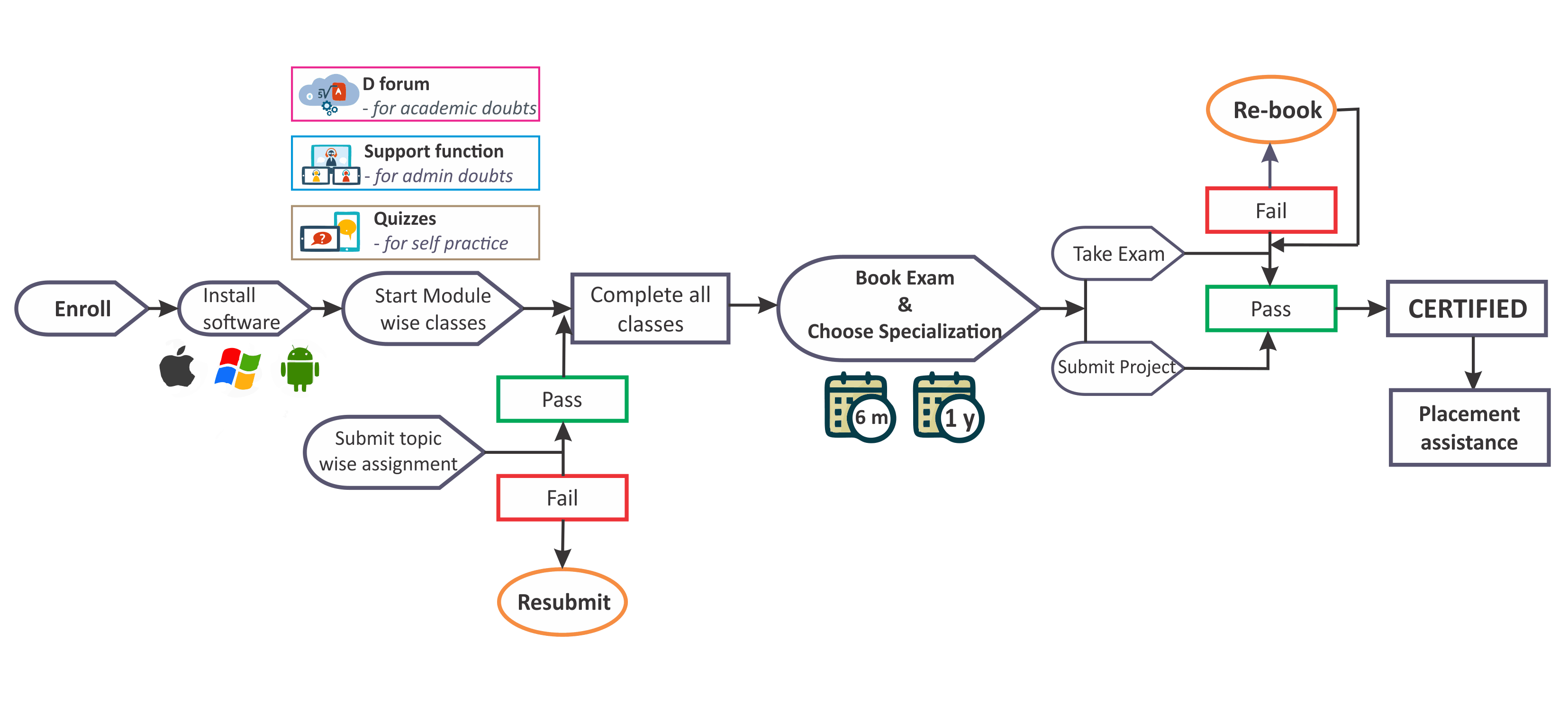

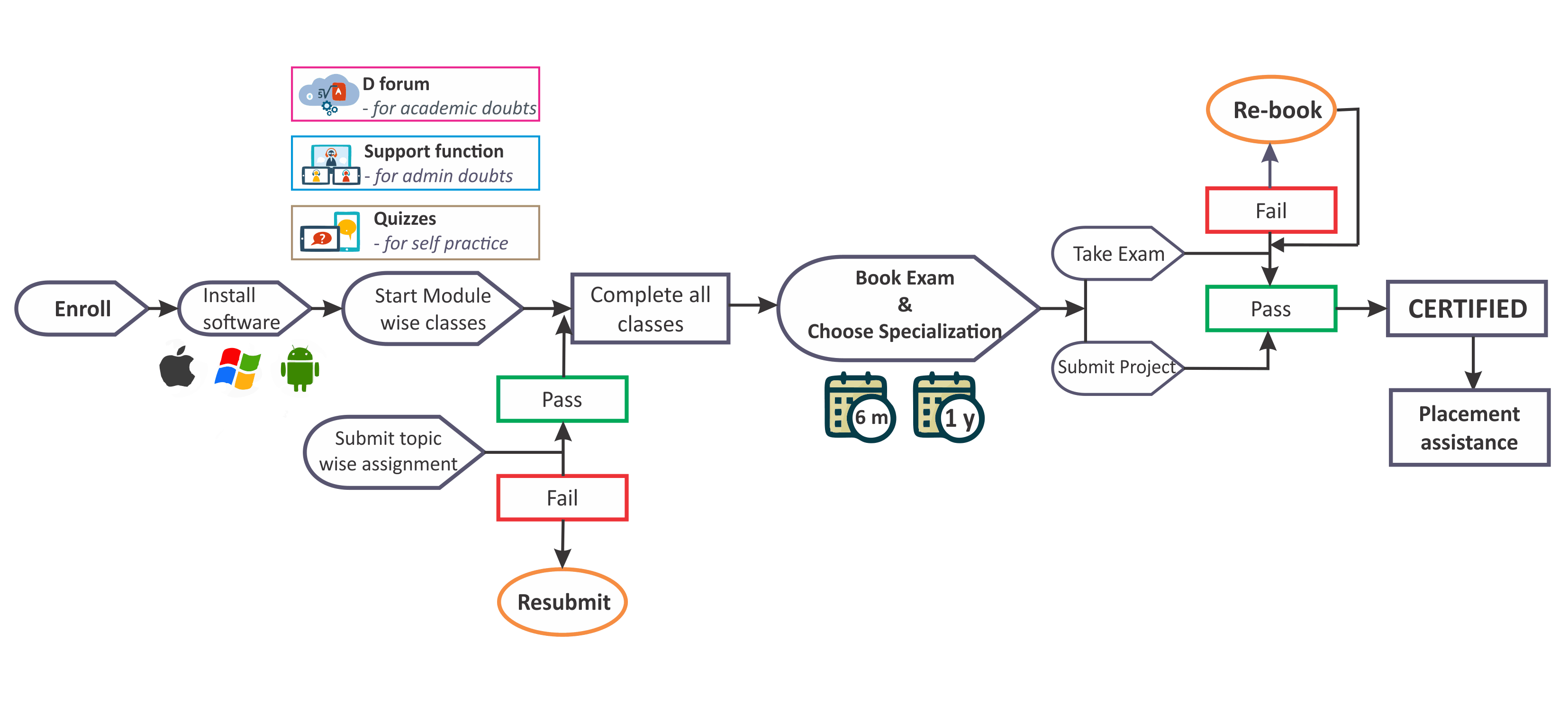

Q4. What is the criteria to get certificate?

Ans.4. To get certificates you need to complete all topic wise assignments, master project and pass the Final exam.

Q5. What is the validity of access of videos?

Ans.5. You can take either 1 year access or lifetime access. Please note that lifetime access is chargeable extra

Q6. Are the videos downloadable or how would the videos play?

Ans.6 With this website we have integrated a customized P2T player that will allow you to play encrypted classes. There are no limitations on the number of views. Also the software is compatible with Windows, Mac, Android or iPhone

Q7. Can we interact with the trainer in case of doubts?

Ans.7. To interact with the trainer we have a dedicated forum ‘D-forum’. Any questions asked on D-forum are expected to be replied within 24 hours by trainers and team of moderators & experts.

Q8. Will I be provided any materials?

Ans.8 Every class is supported by One note files and excel sheets,all these are available in the course section only.

Q10. How do I get the Letter of Recommendation?

Ans. 10. You get Letter of Recommendation mailed to you within 60 days of passing the exam. LOR’s also mention the chosen specialisation with the project details.

CREDIT RISK MODELLING [225+ hours]

EXCEL + PYTHON

Basic Understanding

| Sn | Topics |

|---|---|

| 01 | Understanding Loan Lifecycle |

| 02 | Scorecards vs Basel vs IFRS9 vs CCAR models |

| 03 | Excel hands-on – Data Preparation for Model development |

Scorecards

| 1. | Application Scorecard vs Behavioural Scorecard |

| 2. | Understanding Bad definition |

| 3. | Excel hands-on - Roll Rate Analysis (to incorporate bad flag) on Fannie Mae Mortgage data |

| 4. | Understanding concepts of Snapshot, Observation Period & Performance Period |

| 5. | Excel hands-on - Seasoning analysis to identify Performance Window |

| 6. | Thinking beyond Statistics - Policy rules, Overrides, Reject Inferencing |

| 7. | Excel and Python hands-on – Building Application Scorecards using Logistic Regression |

| 8. | Excel and Python hands-on – Building Behavioural Scorecards using Logistic Regression |

Loss Modelling

| 1. | Excel hands-on - Modelling Losses through Vintage analysis |

| 2. | Excel hands-on – Modelling Losses using Flow Rate Approach |

Modelling Probability of Default

| 01 | Excel hands-on -Calculating PD using Logistic Regression |

| 02 | Calculating PD using Machine Learning Techniques |

| 03 | PD segmentation using Decision trees |

Modelling Loss given Default

| 01 | Calculating workout LGD (Excel) |

| 02 | Tobit & Beta Regression for LGD Modelling (Excel) |

| 03 | Tobit & Beta Regression for LGD Modelling (Excel) |

| 04 | Incomplete workout approach (Excel) |

Modelling Exposure at Default

| 01 | Modelling EAD using CCF (Excel) |

| 02 | CCF calculation using Fixed & Variable Horizon, Cohort approach (Excel) |

| 03 | CCF Regression (Excel) |

Cure Modelling

| 01 | Instant Cure vs Probationary Cure (Model design) |

| 02 | Loss given Cure modelling |

Basel Capital Charge

| 01 | RWA & Capital Adequacy Ratio calculations (Excel) |

| 02 | Using Vasicek formula to convert TTC PD to Worst Case PD |

| 03 | Calculating Capital as per Basel IRB Approach (Excel and Python) |

IFRS 9 Introduction

| 01 | TTC PD in Basel vs PIT PD in IFRS |

| 02 | 12 months PD calculation vs lifetime PD calculation |

| 03 | Understanding Concepts of Staging – Stage 1| Stage 2 | Stage 3 |

IFRS 9 PD Calculation

| 01 | Understanding Conditional PD Vs Unconditional PD |

| 02 | Excel and Python hands-on – Converting TTC PD to PIT PD using Z score |

| 03 | Excel and Python hands-on – Converting TTC PD to PIT PD using Log Odds shift |

| 04 | Excel and Python hands-on – Converting TTC PD to PIT PD using Scalar approach |

| 05 | Calibration & Smoothening techniques (Excel) |

CECL techniques

| 01 | Discrete Time Hazard Models (Excel) |

| 02 | Snapshot/Open Pool Method |

| 03 | WARM Model (Excel) |

| 04 | Vintage analysis (Excel) |

Actuarial Credit Risk Models

| 01 | Survival analysis (Excel) |

| 02 | Lee Carter Model (Excel) |

| 03 | Age Period Cohort Analysis (Excel) |

APC Extensions

| 01 | Validating APC - Alternating Vintage Diagrams, Moran's D (Excel) |

| 02 | Bayesian APC (Excel) |

| 03 | Quantifying Adverse Selection by Vintage (Excel) |

| 04 | Adverse Selection through Fixed and Random effects (Excel) |

IFRS 9 LGD & EAD Calculation

| 01 | PIT forward looking term structure of LGD as a function of Collateral value (Excel) |

| 02 | PIT forward looking term structure of LGD using Regression (Excel) |

| 03 | Calculating PIT LGD using Jacob Frye model (Excel) |

| 04 | CCF Term structure using Regression (Excel) |

IFRS 9 Wholesale Models

| 01 | Understanding Transition Matrices |

| 02 | Building Transition Matrix using Cohort Approach (Excel and Python) |

| 03 | Building Transition Matrix using Duration Approach (Excel and Python) |

| 04 | Converting TTC Transition Matrix to PIT Transition matrix (Excel and Python) |

| 05 | Validating Transition Matrices (Excel) |

Low Default Portfolios

| 01 | Bayesian approach to handle LDP (Excel) |

| 02 | Pluto Tasche Approach (Excel) |

| 03 | Van Der Burgt Method (Excel) |

| 04 | QMM Method (Excel) |

Stress Testing

| 01 | Top Down vs Bottom Up stress Testing (Excel) |

| 02 | Understandings CCAR vs DFAST requirements |

| 03 | Excel hands-on – Modelling ARIMA & ARIMAX |

| 04 | Excel and Python hands-on – Building CCAR models using multiple regression & time series models |

| 07 | Excel hands-on – Perform 9 quarter In Sample & Out of Sample Backtesting |

| 08 | Backtesting & Benchmarking |

Model Validation

| 01 | Evaluating Discriminatory Power Of Model (Excel) |

| 02 | Evaluating Accuracy of Model and Calibration (Excel) |

| 03 | Performing Stability analysis (Excel) |

| 04 | Margin of Conservatism (Excel) |

| 05 | Validating Wholesale Models (Excel) |

| 06 | Validating Stress Testing Models (Excel) |

Pricing Loans

| 01 | Optimizing Yields using Solver (Excel) |

| 02 | RAROC based pricing (Excel) |

Corporate Credit Models

| 01 | Merton & KMV Models (Excel) |

| 02 | Credit Plus Models (Excel) |

| 03 | Credit Portfolio View (Excel) |

| 04 | Credit Metrics Model (Excel) |

We provide Dedicated 60 hrs of Python Modelling sessions specifically for credit risk models apart from the above lectures.

Karan is a highly skilled & knowledgeable Corporate trainer with 5+ years of total work experience spanning across Financial Modelling & Data Analytics. Known for having a knack for problem solving, thought leadership, highly analytical mindset, intrapreneurship, solid fundamentals & learning aptitude. Spearheaded several solution accelerators and spreadsheet based prototypes in Risk and Analytics space.

Q1. What are the pre-requisites to this course?

Ans. 1. Anyone with finance background like having studied some level of CFA FRM or actuaries can join this program.

Q2. Can I join this program if I have little stats and excel background ?

Ans.2. Some basic knowledge of statistics and excel is must to attend this program.

Q3. This course covers only theory or models as well?

Ans 3. This course is quite long & comprehensive only because we have covered the entire curriculum in 3 parts – theory discussion, visualisations in excel, practical implementation through hands-on session in excel.

Q4. What is the criteria to get certificate?

Ans.4. To get certificates you need to complete all topic wise assignments, master project and pass the Final exam.

Q5. What is the validity of access of videos?

Ans.5. You can take either 1 year access or lifetime access. Please note that lifetime access is chargeable extra

Q6. Are the videos downloadable or how would the videos play?

Ans.6 With this website we have integrated a customized P2T player that will allow you to play encrypted classes. There are no limitations on the number of views. Also the software is compatible with Windows, Mac, Android or iPhone

Q7. Can we interact with the trainer in case of doubts?

Ans.7. To interact with the trainer we have a dedicated forum ‘D-forum’. Any questions asked on D-forum are expected to be replied within 24 hours by trainers and team of moderators & experts.

Q8. Will I be provided any materials?

Ans.8 Every class is supported by One note files and excel sheets,all these are available in the course section only.

Q10. How do I get the Letter of Recommendation?

Ans. 10. You get Letter of Recommendation mailed to you within 60 days of passing the exam. LOR’s also mention the chosen specialisation with the project details.