BOOTCAMP Cash Intraday

As a swing trader or positional trader, the most important challenge is to create dynamic filters that helps to screen stocks out of a long list of stocks listed on NSE and BSE. This training fulfills the following 2 objectives

1. Learning how to write lines of code to create screeners to filter out stocks in various segments like F&O, Nifty 50, Midcap 200, Midcap 500, Bank Nifty

2. Learning to balance between Intraday and Positional trading to create a peaceful trading system

| Sln | Topics |

| 01 | Revision of most important technical analysis parameters |

| 02 | Understanding components of Chartink |

| 03 | Chart Interface settings - 5 minutes | 15 minutes | Daily charts |

| 04 | Creating basic filters in Chartink |

| 05 | Intraday buying setups - 15 mins breakout | Intraday buying | Volume Spike |

| 06 | Positional buying setups - Gap Trading | Moving average crossovers |

| 07 | Contrarian buying - 50 Sahara | 200 Sahara |

| 08 | Divergence Trades - RSI bearish divergence |

| 09 | 3M of succesful trading - Momentum Methodology | Money Management | Mind Management |

ABOUT THE TRAINER

Karan Aggarwal is a qualified Chartered Financial Analyst and Financial Risk Manager.

He is the youngest and most dynamic trainer in Kiran Jadhav and Associates with Nevertheless very rich experience in Finance, Stock Markets and Risk Management.

Karan has been instrumental in designing very simple but effective strategies and scanners in stock markets which can be be easily done by maximum retail participants.

Ans. 1. Anyone with finance background like having studied some level of CFA FRM or actuaries can join this program.

Ans.2. Maths Primers and Python Primers have been included in the program, so no previous experience is expected.

Ans 3. This course is quite long & comprehensive only because we have covered the entire curriculum in 3 parts – theory discussion, visualisations in excel, practical implementation through hands-on session in excel & python

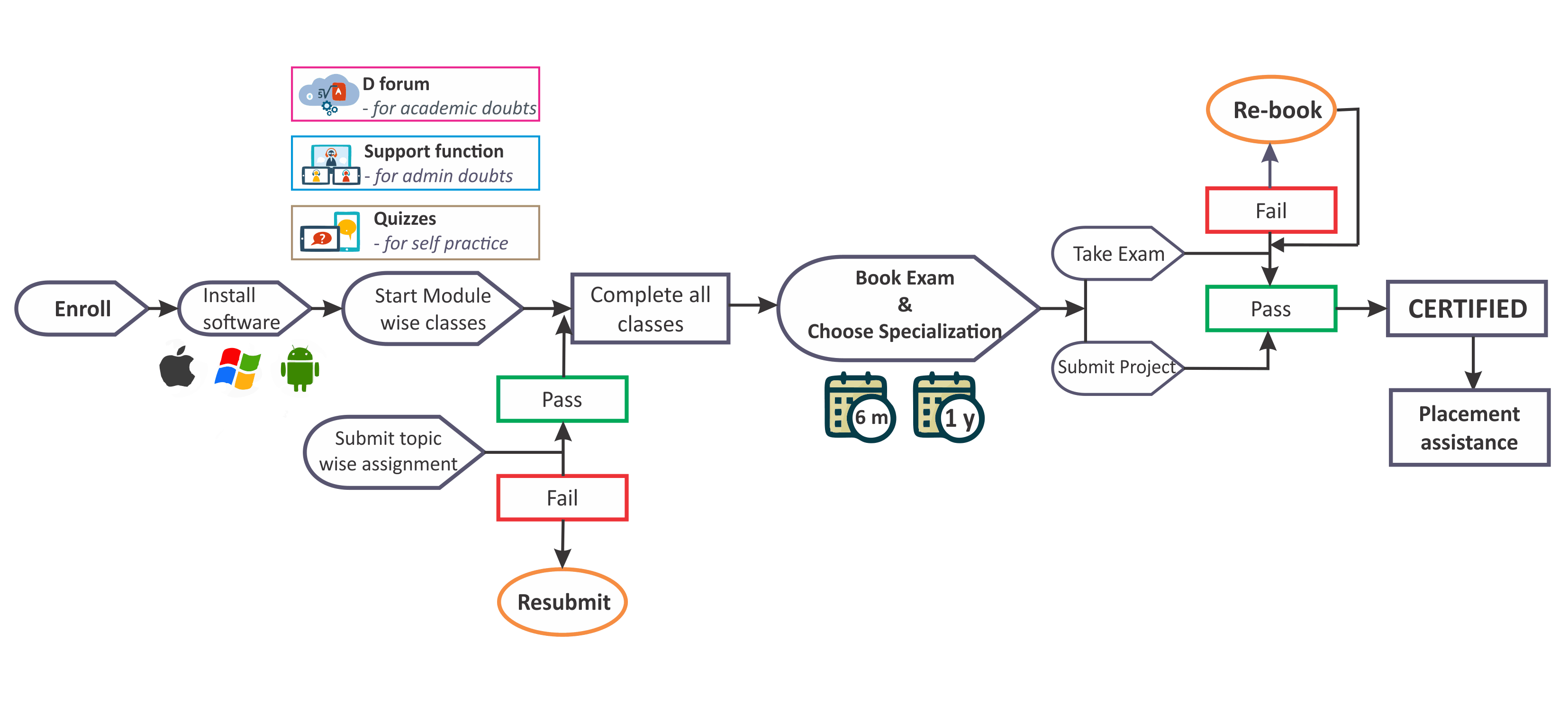

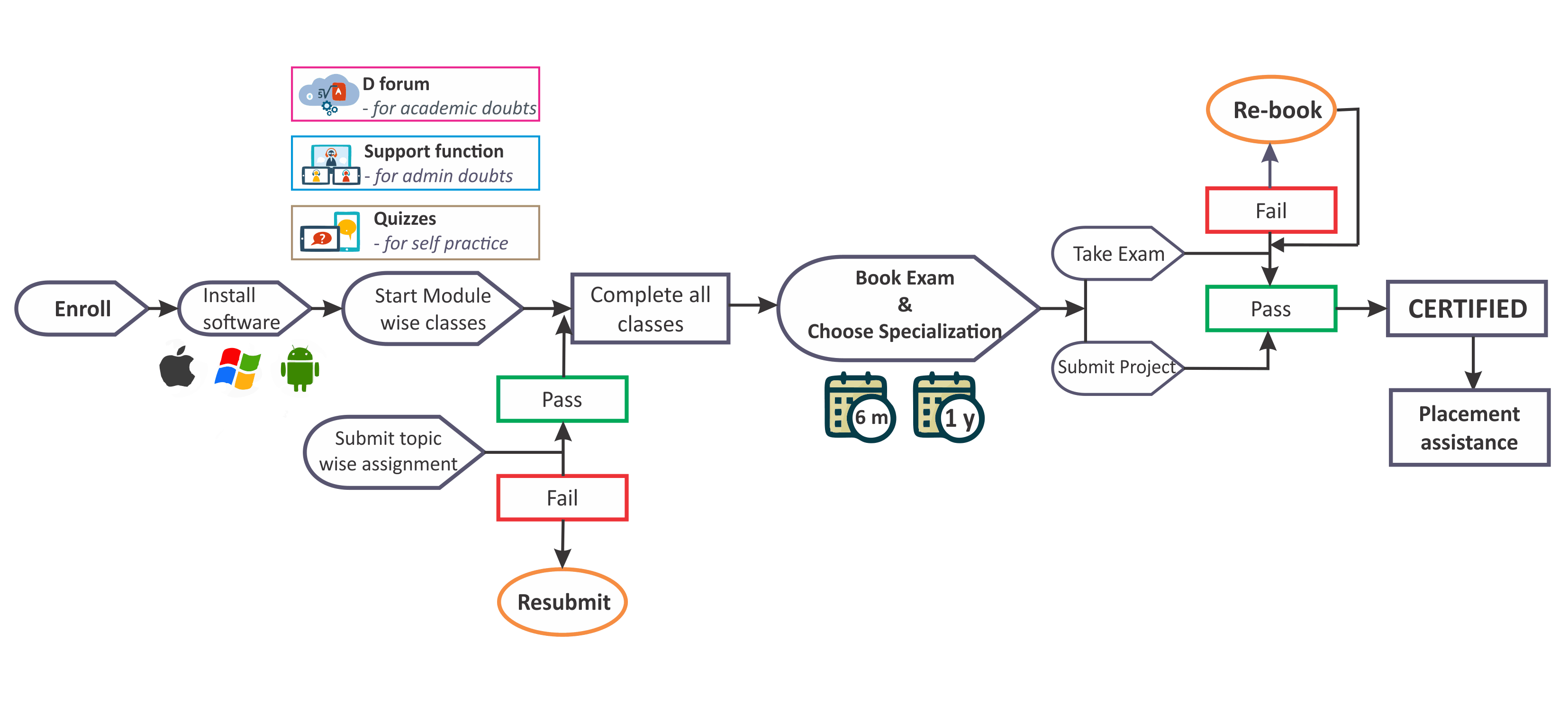

Ans.4. To get certificates you need to complete all topic wise assignments, master project and pass the Final exam.

Ans.5. You can take either 1 year access or lifetime access. Please note that lifetime access is chargeable extra

Ans.6 With this website we have integrated a customized P2T player that will allow you to play encrypted classes. There are no limitations on the number of views. Also the software is compatible with Windows, Mac, Android or iPhone

Ans.7. To interact with the trainer we have a dedicated forum ‘D-forum’. Any questions asked on D-forum are expected to be replied within 24 hours by trainers and team of moderators & experts.

Ans. 8. Presently we are conducting exams in Aug mid and Jan mid. You can choose any of the cohort. In case you are not able to pass the exam in one go, you can re-book at a nominal charge

Ans.9. Every class is supported by One note files, Excel sheets & Python notebooks, Assignments and Quizzes, all these are available in the course section only.

Ans. 10. You get Letter of Recommendation physically delivered to you within 60 days of passing the exam. LOR’s also mention the chosen specialisation with the project details.

As a swing trader or positional trader, the most important challenge is to create dynamic filters that helps to screen stocks out of a long list of stocks listed on NSE and BSE. This training fulfills the following 2 objectives

1. Learning how to write lines of code to create screeners to filter out stocks in various segments like F&O, Nifty 50, Midcap 200, Midcap 500, Bank Nifty

2. Learning to balance between Intraday and Positional trading to create a peaceful trading system

| Sln | Topics |

| 01 | Revision of most important technical analysis parameters |

| 02 | Understanding components of Chartink |

| 03 | Chart Interface settings - 5 minutes | 15 minutes | Daily charts |

| 04 | Creating basic filters in Chartink |

| 05 | Intraday buying setups - 15 mins breakout | Intraday buying | Volume Spike |

| 06 | Positional buying setups - Gap Trading | Moving average crossovers |

| 07 | Contrarian buying - 50 Sahara | 200 Sahara |

| 08 | Divergence Trades - RSI bearish divergence |

| 09 | 3M of succesful trading - Momentum Methodology | Money Management | Mind Management |

Karan Aggarwal is a qualified Chartered Financial Analyst and Financial Risk Manager.

He is the youngest and most dynamic trainer in Kiran Jadhav and Associates with Nevertheless very rich experience in Finance, Stock Markets and Risk Management.

Karan has been instrumental in designing very simple but effective strategies and scanners in stock markets which can be be easily done by maximum retail participants.

Ans. 1. Anyone with finance background like having studied some level of CFA FRM or actuaries can join this program.

Ans.2. Maths Primers and Python Primers have been included in the program, so no previous experience is expected.

Ans 3. This course is quite long & comprehensive only because we have covered the entire curriculum in 3 parts – theory discussion, visualisations in excel, practical implementation through hands-on session in excel & python

Ans.4. To get certificates you need to complete all topic wise assignments, master project and pass the Final exam.

Ans.5. You can take either 1 year access or lifetime access. Please note that lifetime access is chargeable extra

Ans.6 With this website we have integrated a customized P2T player that will allow you to play encrypted classes. There are no limitations on the number of views. Also the software is compatible with Windows, Mac, Android or iPhone

Ans.7. To interact with the trainer we have a dedicated forum ‘D-forum’. Any questions asked on D-forum are expected to be replied within 24 hours by trainers and team of moderators & experts.

Ans. 8. Presently we are conducting exams in Aug mid and Jan mid. You can choose any of the cohort. In case you are not able to pass the exam in one go, you can re-book at a nominal charge

Ans.9. Every class is supported by One note files, Excel sheets & Python notebooks, Assignments and Quizzes, all these are available in the course section only.

Ans. 10. You get Letter of Recommendation physically delivered to you within 60 days of passing the exam. LOR’s also mention the chosen specialisation with the project details.