BOOTCAMP ICAAP, ILAAP and IRRBB

No content

ICAAP, BASEL & LIQUIDITY RISK [75 HOURS]

| Sn | Topics |

Building Blocks |

|

| 01 | Understanding RWA and capital requirements in bank |

| 02 | ICAAP Walkthrough |

| 03 | Interest rate and Liquidity dynamics |

| 04 | Understanding Banks Balance sheet - Deposits, Loans, Borrowings and Investments |

| 05 | Introduction to Value at Risk |

| 06 | Introduction to Regression and Time Series concepts |

| 07 | Introduction to Simulations |

| 08 | Understanding Bonds duration concept |

ICAAP (Internal Capital Adequacy Assessment Program)

| 01 | Pillar 2 Stress Testing |

| 1. | Stress testing for Credit Risk |

| 2. | Stress testing for Market Risk |

| 3. | Stress testing for Credit Risk |

| 4. | Stess testing for Liquidity Risk |

|

Impact of Stress scenarios on CAR and Liquidity ratios |

|

| 02 |

Risks not captured in PIllar 1 |

| 1. |

Interest rate Risk in Banking Book (IRRBB) |

| i. | Preparing Traditional Gap analysis report |

| ii. | Behavioural analysis for CASA, Term deposits renewals and withdrawals, Prepayments on loans etc |

| iii. | Understanding IRRBB - NII and EVE analysis (Repricing risk, Yield curve risk, Basis Risk, Options Risk) |

| iv. | IRRBB Stress |

| 2. |

Concentration Risk |

| i. | PRA and Spanish guidelines |

| ii. | HHI and GA approach |

| 3. |

Building Scorecards |

| i. | Reputational Risk |

| ii. | Strategic Risk |

| iii. | Cyber Risk |

| iv. | Compliance Risk |

| v. | Model Risk |

| 4. |

Climate Risk |

Pillar 1 Minimum Capital Requirements

| 1. | Credit Risk capital using Standardised Approach, FIRB, AIRB |

| 2. | Market risk capital using Standardised duration approach and internal models and basic idea of FRTB |

| 3. | Operational Risk Capital Charge using BIA, SA, AMA and SMA |

| 4. | Basel III to Basel IV reforms |

| 5. | Economic vs Regulatory Capital ( Residual Risk for ICAAP) |

Liquidity Risk Management

| 01 | ALM Evolution and Challenges |

| 02 | Preparing Structural Liquidity Statements and dynamic liquidity statements |

| 03 | Comparing Liquidity Gaps with Limits |

| 04 | Liquidity Coverage ratio |

| 05 | Net Stable Funding ratio |

| 06 | Leverage ratio |

| 07 | Liquidity Risk Stress testing |

| 08 | FTP as a tool for asset liability management |

| 09 | FTP Methods - Single Spilt Pool and Matched Maturity Methods, components of FTP |

| 10 | Liquidity Transfer Pricing |

| 11 | Incorporating FTP into RAROC |

| 12 | ILAAP report |

ABOUT THE TRAINER

No content

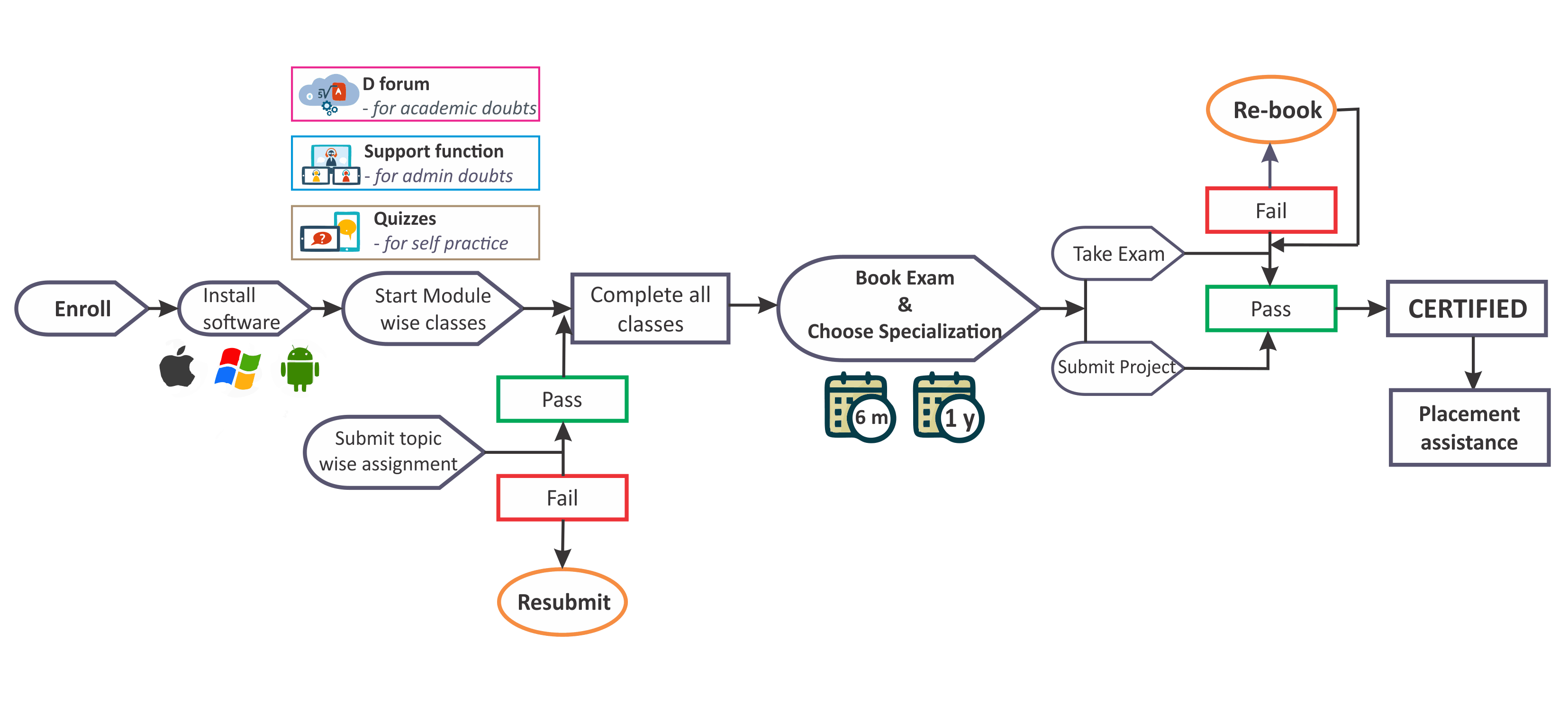

Ans. 1. Anyone with finance background like having studied some level of CFA FRM or actuaries can join this program.

Ans.2. Maths Primers and Python Primers have been included in the program, so no previous experience is expected.

Ans 3. This course is quite long & comprehensive only because we have covered the entire curriculum in 3 parts – theory discussion, visualisations in excel, practical implementation through hands-on session in excel & python

Ans.4. To get certificates you need to complete all topic wise assignments, master project and pass the Final exam.

Ans.5. You can take either 1 year access or lifetime access. Please note that lifetime access is chargeable extra

Ans.6 With this website we have integrated a customized P2T player that will allow you to play encrypted classes. There are no limitations on the number of views. Also the software is compatible with Windows, Mac, Android or iPhone

Ans.7. To interact with the trainer we have a dedicated forum ‘D-forum’. Any questions asked on D-forum are expected to be replied within 24 hours by trainers and team of moderators & experts.

Ans. 8. Presently we are conducting exams in Aug mid and Jan mid. You can choose any of the cohort. In case you are not able to pass the exam in one go, you can re-book at a nominal charge

Ans.9. Every class is supported by One note files, Excel sheets & Python notebooks, Assignments and Quizzes, all these are available in the course section only.

Ans. 10. You get Letter of Recommendation physically delivered to you within 60 days of passing the exam. LOR’s also mention the chosen specialisation with the project details.

No content

ICAAP, BASEL & LIQUIDITY RISK [75 HOURS]

| Sn | Topics |

Building Blocks |

|

| 01 | Understanding RWA and capital requirements in bank |

| 02 | ICAAP Walkthrough |

| 03 | Interest rate and Liquidity dynamics |

| 04 | Understanding Banks Balance sheet - Deposits, Loans, Borrowings and Investments |

| 05 | Introduction to Value at Risk |

| 06 | Introduction to Regression and Time Series concepts |

| 07 | Introduction to Simulations |

| 08 | Understanding Bonds duration concept |

ICAAP (Internal Capital Adequacy Assessment Program)

| 01 | Pillar 2 Stress Testing |

| 1. | Stress testing for Credit Risk |

| 2. | Stress testing for Market Risk |

| 3. | Stress testing for Credit Risk |

| 4. | Stess testing for Liquidity Risk |

|

Impact of Stress scenarios on CAR and Liquidity ratios |

|

| 02 |

Risks not captured in PIllar 1 |

| 1. |

Interest rate Risk in Banking Book (IRRBB) |

| i. | Preparing Traditional Gap analysis report |

| ii. | Behavioural analysis for CASA, Term deposits renewals and withdrawals, Prepayments on loans etc |

| iii. | Understanding IRRBB - NII and EVE analysis (Repricing risk, Yield curve risk, Basis Risk, Options Risk) |

| iv. | IRRBB Stress |

| 2. |

Concentration Risk |

| i. | PRA and Spanish guidelines |

| ii. | HHI and GA approach |

| 3. |

Building Scorecards |

| i. | Reputational Risk |

| ii. | Strategic Risk |

| iii. | Cyber Risk |

| iv. | Compliance Risk |

| v. | Model Risk |

| 4. |

Climate Risk |

Pillar 1 Minimum Capital Requirements

| 1. | Credit Risk capital using Standardised Approach, FIRB, AIRB |

| 2. | Market risk capital using Standardised duration approach and internal models and basic idea of FRTB |

| 3. | Operational Risk Capital Charge using BIA, SA, AMA and SMA |

| 4. | Basel III to Basel IV reforms |

| 5. | Economic vs Regulatory Capital ( Residual Risk for ICAAP) |

Liquidity Risk Management

| 01 | ALM Evolution and Challenges |

| 02 | Preparing Structural Liquidity Statements and dynamic liquidity statements |

| 03 | Comparing Liquidity Gaps with Limits |

| 04 | Liquidity Coverage ratio |

| 05 | Net Stable Funding ratio |

| 06 | Leverage ratio |

| 07 | Liquidity Risk Stress testing |

| 08 | FTP as a tool for asset liability management |

| 09 | FTP Methods - Single Spilt Pool and Matched Maturity Methods, components of FTP |

| 10 | Liquidity Transfer Pricing |

| 11 | Incorporating FTP into RAROC |

| 12 | ILAAP report |

No content

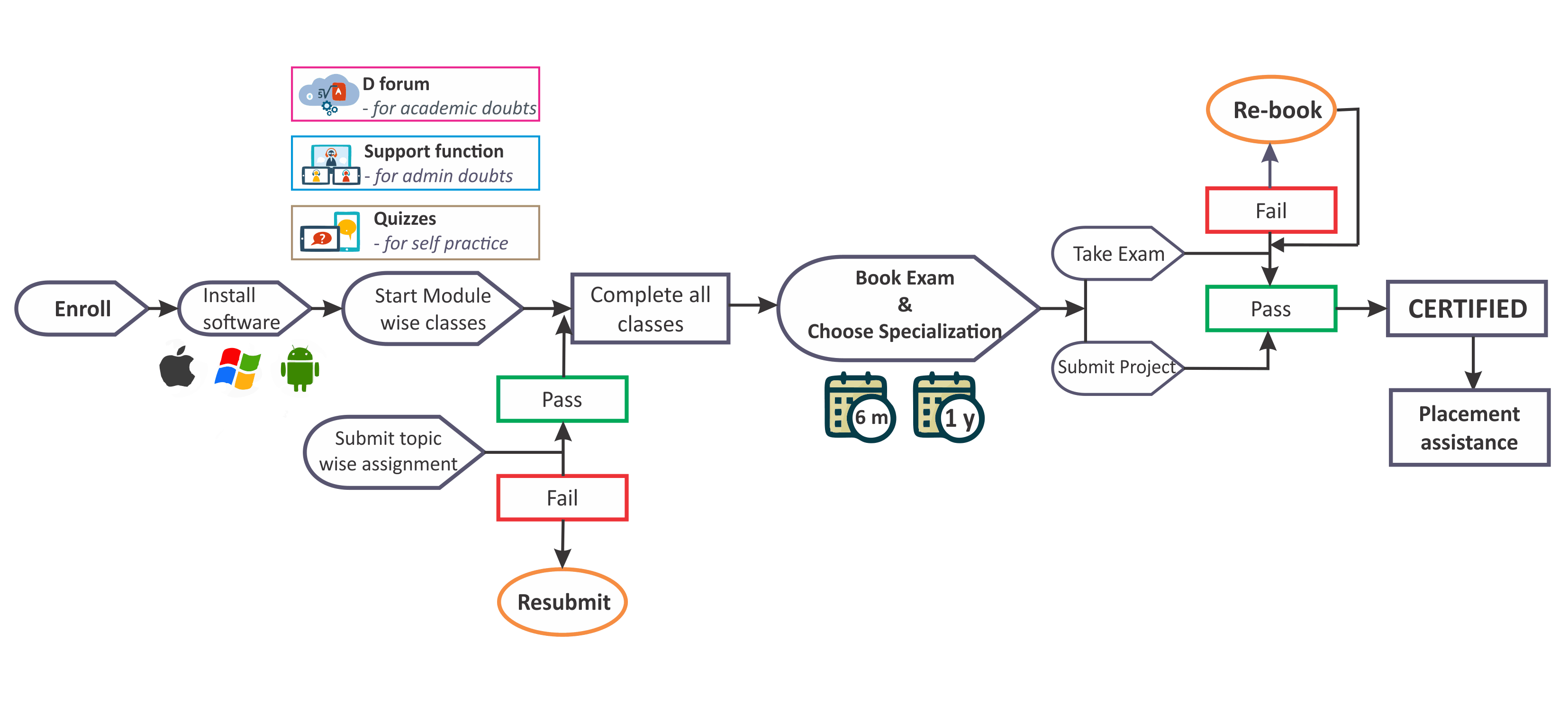

Ans. 1. Anyone with finance background like having studied some level of CFA FRM or actuaries can join this program.

Ans.2. Maths Primers and Python Primers have been included in the program, so no previous experience is expected.

Ans 3. This course is quite long & comprehensive only because we have covered the entire curriculum in 3 parts – theory discussion, visualisations in excel, practical implementation through hands-on session in excel & python

Ans.4. To get certificates you need to complete all topic wise assignments, master project and pass the Final exam.

Ans.5. You can take either 1 year access or lifetime access. Please note that lifetime access is chargeable extra

Ans.6 With this website we have integrated a customized P2T player that will allow you to play encrypted classes. There are no limitations on the number of views. Also the software is compatible with Windows, Mac, Android or iPhone

Ans.7. To interact with the trainer we have a dedicated forum ‘D-forum’. Any questions asked on D-forum are expected to be replied within 24 hours by trainers and team of moderators & experts.

Ans. 8. Presently we are conducting exams in Aug mid and Jan mid. You can choose any of the cohort. In case you are not able to pass the exam in one go, you can re-book at a nominal charge

Ans.9. Every class is supported by One note files, Excel sheets & Python notebooks, Assignments and Quizzes, all these are available in the course section only.

Ans. 10. You get Letter of Recommendation physically delivered to you within 60 days of passing the exam. LOR’s also mention the chosen specialisation with the project details.