BOOTCAMP Deep Quant Finance

No content

Derivatives Valuations & Risk Portfolio Management (DQF) [175 HOURS]

| Sn | Topics |

| Finance basics with Python | |

| 01 |

Setting up Python Infrastructure

|

| 02 |

Arithmetic operations

|

| 03 |

Data Structure

|

| 04 |

Object Oriented Programming

PythonLab – Create a Custom Class for Black Scholes Option Price and Greeks |

| 05 |

Numerical computing with NumPy

|

| 06 |

Data Analysis with Pandas

|

| 07 |

Data Visualization with Matplotlib, Seaborn & Cufflinks

|

| 08 |

Calculus

Python Lab – Solving the heat equation |

| 09 |

Numerical Integration

Python Lab – Custom class to find CDF of normal distribution using numerical integration |

| 10 |

Probability & Statistics with SciPy

Python Lab – Custom Class for numerical computation of Expectation and Variance |

| 11 |

Univariate Financial Time Series Analysis with Statsmodels

Excel & Python Lab – Custom class to perform Box-Jenkins methodology to fit the best model. |

| 12 |

Multivariate Financial Time Series Analysis with Statsmodels

Excel & Python Lab – Joint forecasting of macro-economic time series |

| 13 |

Conditional Volatility Models

Excel & Python Lab – Custom Class for Value-at-Risk under different volatility models |

| 14 |

Monte Carlo Methods

|

| 15 |

Copula Models

Excel & Python Lab – Simulating default times for a nth to default basket CDS. . |

| Stochastic Calculus for Finance | |

| 01 |

Stochastic process

|

| 02 |

Change of Measure

Excel & Python Lab – ABM, GBM, OU |

| Equity Derivatives | |

| 01 |

Binomial Asset Pricing Model

|

| 02 |

Black Scholes

|

| 03 |

Jump Process

|

| 04 |

Finite Difference Methods for Option pricing

Excel & Python Lab – Price first generation exotics using Finite Difference |

| 05 |

Monte Carlo methods for Option pricing

Excel & Python Lab – Custom class for Exotic pricing and Greeks |

| 06 |

Volatility Surface

Excel & Python Lab – Custom class for pricing under Heston and SABR models |

| Interest Rate & FX Derivatives | |

| 01 |

Rates and Rate Instruments

Excel & Python Lab – valuation of Bonds, FRAs and Swaps |

| 02 |

Term Structure Models

|

| 02 |

Options on rates

Excel & Python Lab – Calibration of swaption volatility surface |

| 03 |

FX Instruments

Excel & Python Lab – Pricing of FX derivatives with volatility smile Excel & Python Lab – CVA calculation for a portfolio of derivatives |

| Quantitative Portfolio Management | |

| 01 |

Portfolio Theory & Optimization

Excel & PythonLab – A real life portfolio optimization problem Excel & Python Lab – Implementation of Pairs-trading (A statistical arbitrage trading strategy) |

| Machine Learning for Finance | |

| 01 |

Traditional Supervised algorithms using Scikit Learn

|

| 02 |

Traditional Unsupervised algorithms using Scikit Learn

|

| 03 |

Deep Learning with Tensorflow

|

ABOUT THE TRAINER

No content

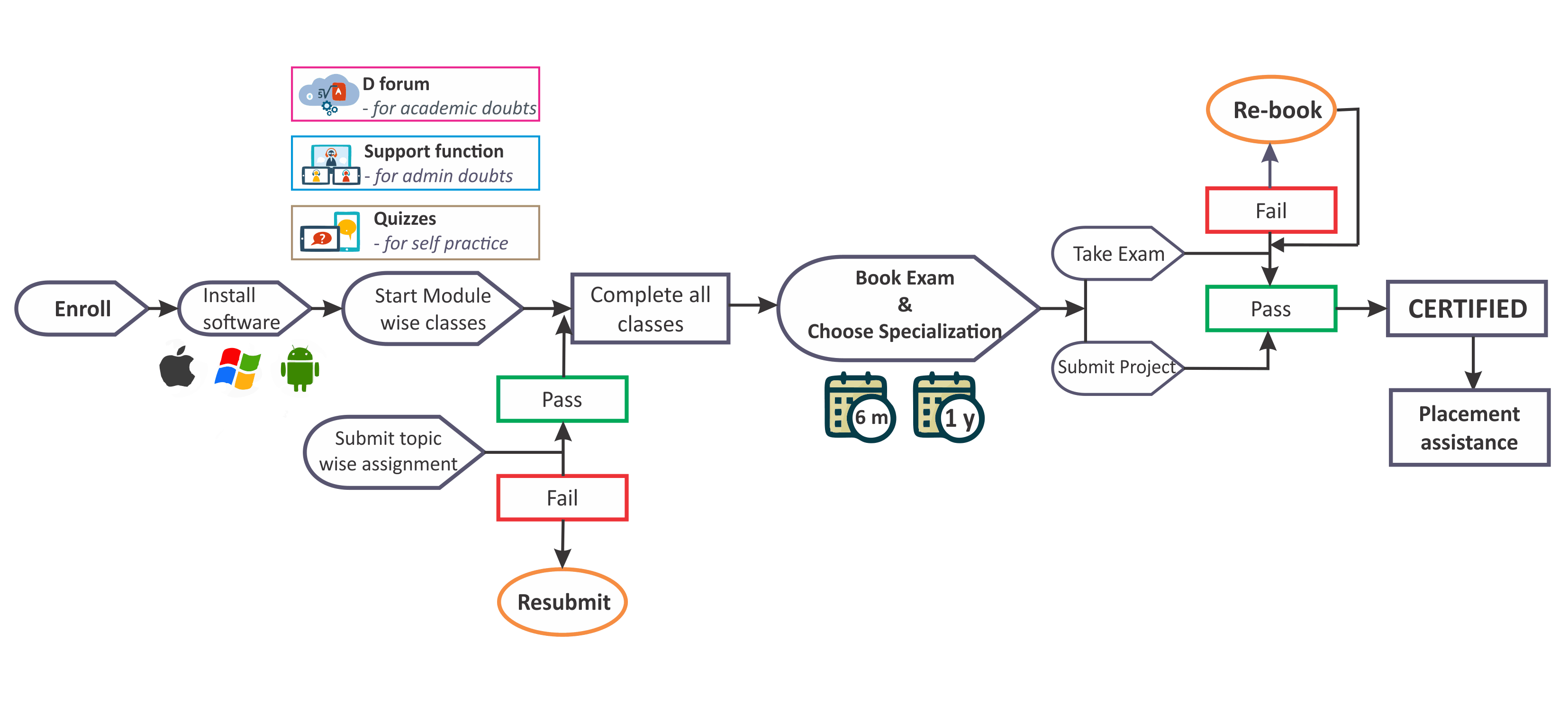

Ans. 1. Anyone with finance background like having studied some level of CFA FRM or actuaries can join this program.

Ans.2. Maths Primers and Python Primers have been included in the program, so no previous experience is expected.

Ans 3. This course is quite long & comprehensive only because we have covered the entire curriculum in 3 parts – theory discussion, visualisations in excel, practical implementation through hands-on session in excel & python

Ans.4. To get certificates you need to complete all topic wise assignments, master project and pass the Final exam.

Ans.5. You can take either 1 year access or lifetime access. Please note that lifetime access is chargeable extra

Ans.6 With this website we have integrated a customized P2T player that will allow you to play encrypted classes. There are no limitations on the number of views. Also the software is compatible with Windows, Mac, Android or iPhone

Ans.7. To interact with the trainer we have a dedicated forum ‘D-forum’. Any questions asked on D-forum are expected to be replied within 24 hours by trainers and team of moderators & experts.

Ans. 8. Presently we are conducting exams in Aug mid and Jan mid. You can choose any of the cohort. In case you are not able to pass the exam in one go, you can re-book at a nominal charge

Ans.9. Every class is supported by One note files, Excel sheets & Python notebooks, Assignments and Quizzes, all these are available in the course section only.

Ans. 10. You get Letter of Recommendation physically delivered to you within 60 days of passing the exam. LOR’s also mention the chosen specialisation with the project details.

No content

Derivatives Valuations & Risk Portfolio Management (DQF) [175 HOURS]

| Sn | Topics |

| Finance basics with Python | |

| 01 |

Setting up Python Infrastructure

|

| 02 |

Arithmetic operations

|

| 03 |

Data Structure

|

| 04 |

Object Oriented Programming

PythonLab – Create a Custom Class for Black Scholes Option Price and Greeks |

| 05 |

Numerical computing with NumPy

|

| 06 |

Data Analysis with Pandas

|

| 07 |

Data Visualization with Matplotlib, Seaborn & Cufflinks

|

| 08 |

Calculus

Python Lab – Solving the heat equation |

| 09 |

Numerical Integration

Python Lab – Custom class to find CDF of normal distribution using numerical integration |

| 10 |

Probability & Statistics with SciPy

Python Lab – Custom Class for numerical computation of Expectation and Variance |

| 11 |

Univariate Financial Time Series Analysis with Statsmodels

Excel & Python Lab – Custom class to perform Box-Jenkins methodology to fit the best model. |

| 12 |

Multivariate Financial Time Series Analysis with Statsmodels

Excel & Python Lab – Joint forecasting of macro-economic time series |

| 13 |

Conditional Volatility Models

Excel & Python Lab – Custom Class for Value-at-Risk under different volatility models |

| 14 |

Monte Carlo Methods

|

| 15 |

Copula Models

Excel & Python Lab – Simulating default times for a nth to default basket CDS. . |

| Stochastic Calculus for Finance | |

| 01 |

Stochastic process

|

| 02 |

Change of Measure

Excel & Python Lab – ABM, GBM, OU |

| Equity Derivatives | |

| 01 |

Binomial Asset Pricing Model

|

| 02 |

Black Scholes

|

| 03 |

Jump Process

|

| 04 |

Finite Difference Methods for Option pricing

Excel & Python Lab – Price first generation exotics using Finite Difference |

| 05 |

Monte Carlo methods for Option pricing

Excel & Python Lab – Custom class for Exotic pricing and Greeks |

| 06 |

Volatility Surface

Excel & Python Lab – Custom class for pricing under Heston and SABR models |

| Interest Rate & FX Derivatives | |

| 01 |

Rates and Rate Instruments

Excel & Python Lab – valuation of Bonds, FRAs and Swaps |

| 02 |

Term Structure Models

|

| 02 |

Options on rates

Excel & Python Lab – Calibration of swaption volatility surface |

| 03 |

FX Instruments

Excel & Python Lab – Pricing of FX derivatives with volatility smile Excel & Python Lab – CVA calculation for a portfolio of derivatives |

| Quantitative Portfolio Management | |

| 01 |

Portfolio Theory & Optimization

Excel & PythonLab – A real life portfolio optimization problem Excel & Python Lab – Implementation of Pairs-trading (A statistical arbitrage trading strategy) |

| Machine Learning for Finance | |

| 01 |

Traditional Supervised algorithms using Scikit Learn

|

| 02 |

Traditional Unsupervised algorithms using Scikit Learn

|

| 03 |

Deep Learning with Tensorflow

|

No content

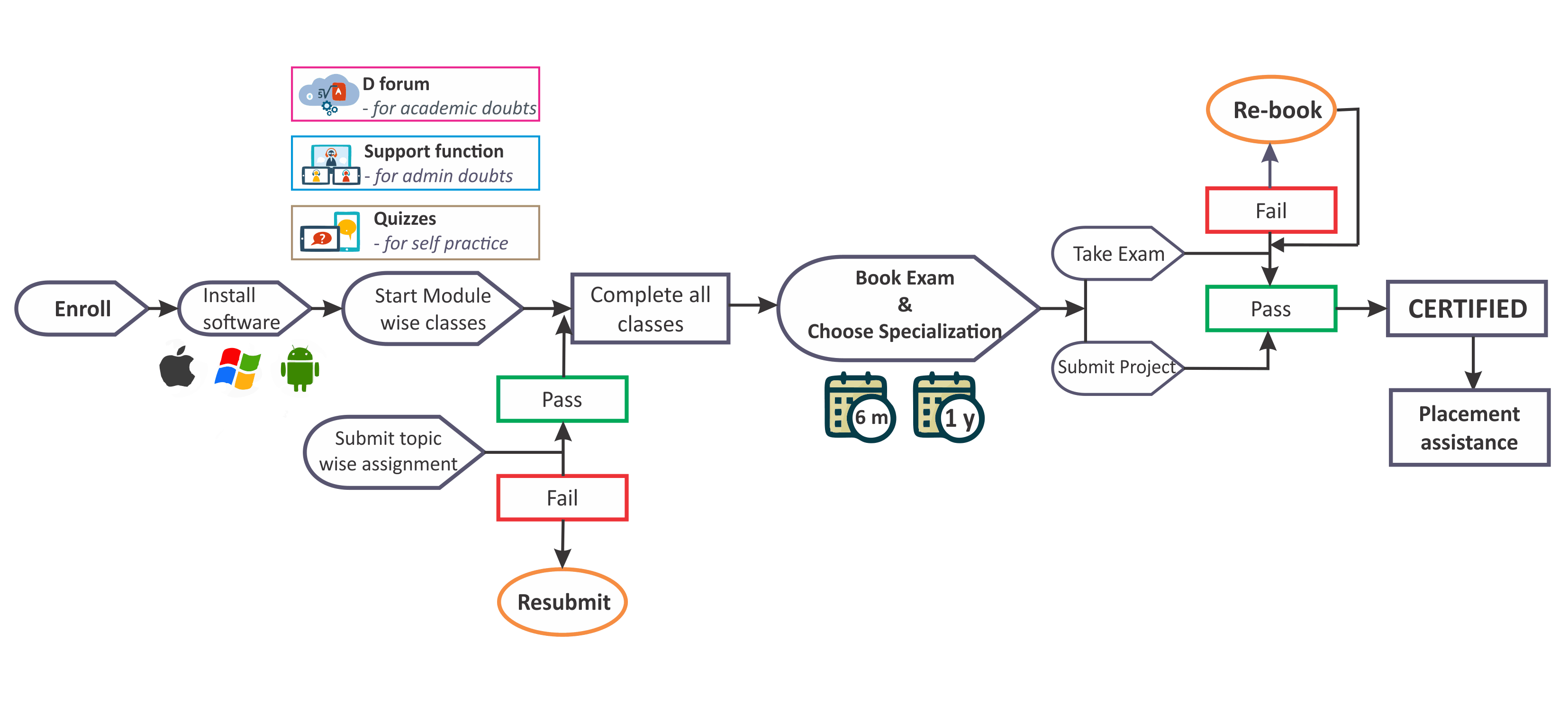

Ans. 1. Anyone with finance background like having studied some level of CFA FRM or actuaries can join this program.

Ans.2. Maths Primers and Python Primers have been included in the program, so no previous experience is expected.

Ans 3. This course is quite long & comprehensive only because we have covered the entire curriculum in 3 parts – theory discussion, visualisations in excel, practical implementation through hands-on session in excel & python

Ans.4. To get certificates you need to complete all topic wise assignments, master project and pass the Final exam.

Ans.5. You can take either 1 year access or lifetime access. Please note that lifetime access is chargeable extra

Ans.6 With this website we have integrated a customized P2T player that will allow you to play encrypted classes. There are no limitations on the number of views. Also the software is compatible with Windows, Mac, Android or iPhone

Ans.7. To interact with the trainer we have a dedicated forum ‘D-forum’. Any questions asked on D-forum are expected to be replied within 24 hours by trainers and team of moderators & experts.

Ans. 8. Presently we are conducting exams in Aug mid and Jan mid. You can choose any of the cohort. In case you are not able to pass the exam in one go, you can re-book at a nominal charge

Ans.9. Every class is supported by One note files, Excel sheets & Python notebooks, Assignments and Quizzes, all these are available in the course section only.

Ans. 10. You get Letter of Recommendation physically delivered to you within 60 days of passing the exam. LOR’s also mention the chosen specialisation with the project details.