BOOTCAMP Bonds Techno Funda

| Sn | Topics |

| 01 | Understanding impact of various Macro-economic factors on Bond Markets |

| 02 | Understanding the stages of Business Cycles and relevant portfolio management strategy |

| 03 | Understanding Yield Curve - Normal, Steep and Inverted |

| 04 | Interlinkages and Interrelationships between various macro economic factors |

| 05 | Technical Analysis - Intermarket analysis (Bonds, Stocks, Commodities, US Dollar) |

| 06 | Technical Analysis - Studying Price patterns |

| 07 | Checklist based objective analysis of Business Cycle, Interest rates, Yield curve, Intermarket play and Bond Strategy |

| 08 | Micro economic factors for asset allocations and debt portfolio management |

| 09 | Bond Portfolio Management philosophy - Safety, Liquidity & Adjusted Returns |

| 10 | Bond Portfolio Management strategy - Duration vs Accural Play |

ABOUT THE TRAINER

No content

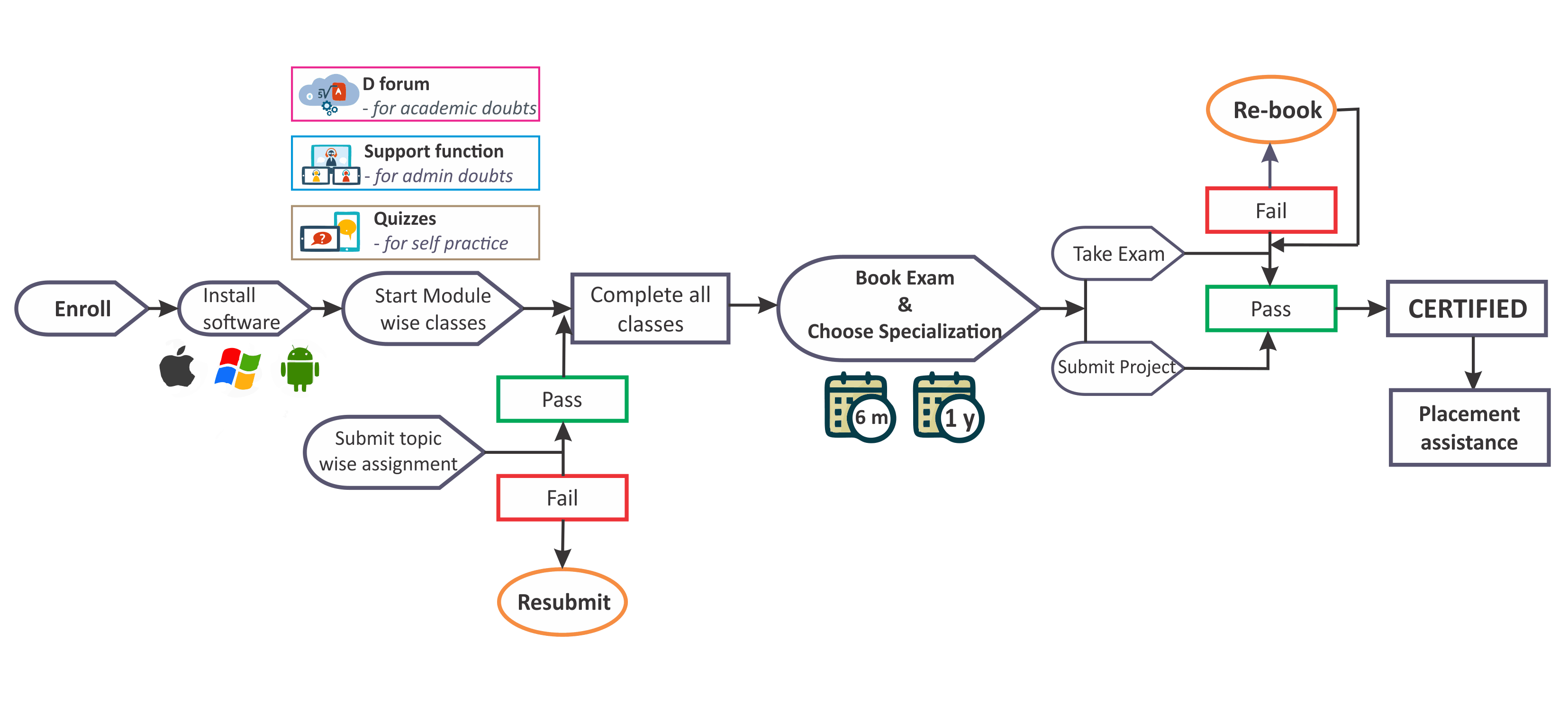

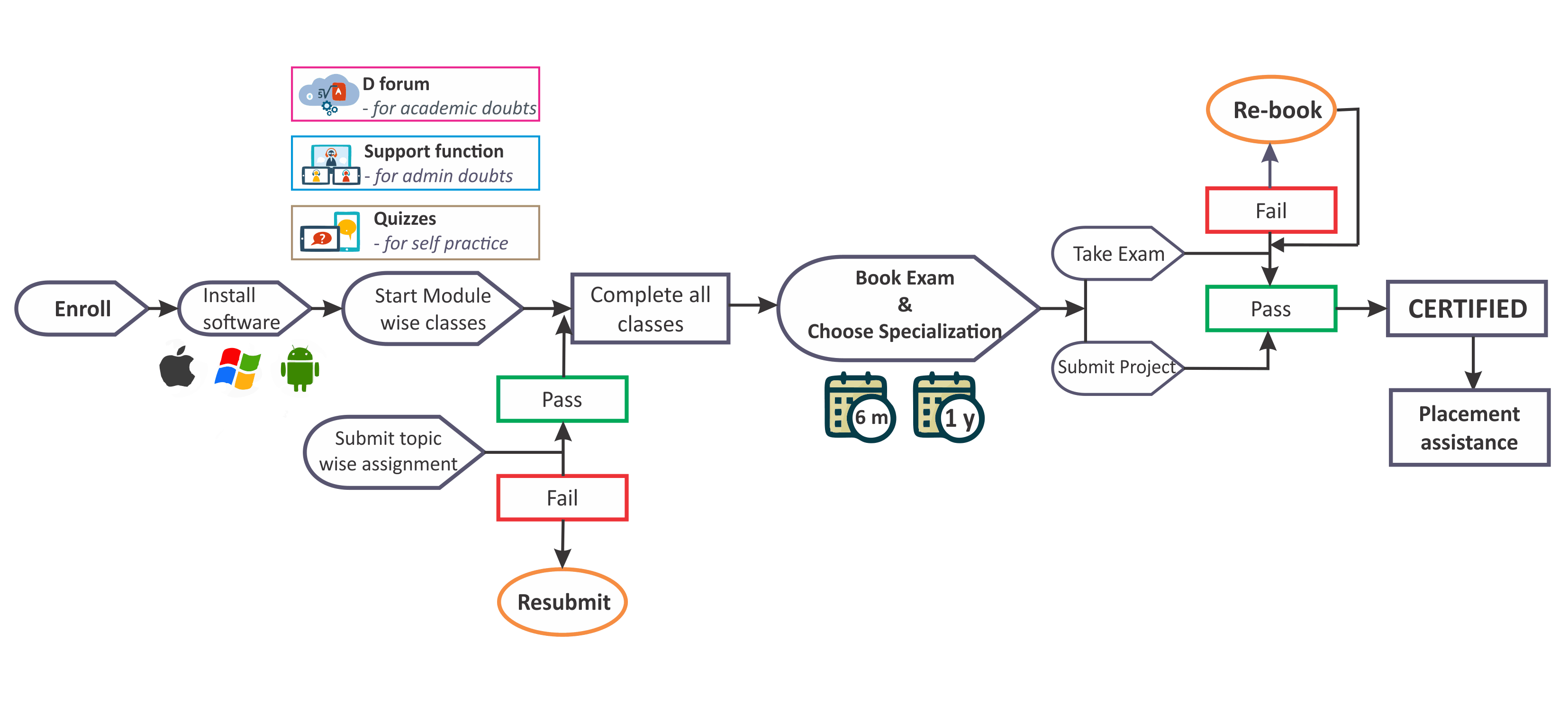

Ans. 1. Anyone with finance background like having studied some level of CFA FRM or actuaries can join this program.

Ans.2. Maths Primers and Python Primers have been included in the program, so no previous experience is expected.

Ans 3. This course is quite long & comprehensive only because we have covered the entire curriculum in 3 parts – theory discussion, visualisations in excel, practical implementation through hands-on session in excel & python

Ans.4. To get certificates you need to complete all topic wise assignments, master project and pass the Final exam.

Ans.5. You can take either 1 year access or lifetime access. Please note that lifetime access is chargeable extra

Ans.6 With this website we have integrated a customized P2T player that will allow you to play encrypted classes. There are no limitations on the number of views. Also the software is compatible with Windows, Mac, Android or iPhone

Ans.7. To interact with the trainer we have a dedicated forum ‘D-forum’. Any questions asked on D-forum are expected to be replied within 24 hours by trainers and team of moderators & experts.

Ans. 8. Presently we are conducting exams in Aug mid and Jan mid. You can choose any of the cohort. In case you are not able to pass the exam in one go, you can re-book at a nominal charge

Ans.9. Every class is supported by One note files, Excel sheets & Python notebooks, Assignments and Quizzes, all these are available in the course section only.

Ans. 10. You get Letter of Recommendation physically delivered to you within 60 days of passing the exam. LOR’s also mention the chosen specialisation with the project details.

| Sn | Topics |

| 01 | Understanding impact of various Macro-economic factors on Bond Markets |

| 02 | Understanding the stages of Business Cycles and relevant portfolio management strategy |

| 03 | Understanding Yield Curve - Normal, Steep and Inverted |

| 04 | Interlinkages and Interrelationships between various macro economic factors |

| 05 | Technical Analysis - Intermarket analysis (Bonds, Stocks, Commodities, US Dollar) |

| 06 | Technical Analysis - Studying Price patterns |

| 07 | Checklist based objective analysis of Business Cycle, Interest rates, Yield curve, Intermarket play and Bond Strategy |

| 08 | Micro economic factors for asset allocations and debt portfolio management |

| 09 | Bond Portfolio Management philosophy - Safety, Liquidity & Adjusted Returns |

| 10 | Bond Portfolio Management strategy - Duration vs Accural Play |

No content

Ans. 1. Anyone with finance background like having studied some level of CFA FRM or actuaries can join this program.

Ans.2. Maths Primers and Python Primers have been included in the program, so no previous experience is expected.

Ans 3. This course is quite long & comprehensive only because we have covered the entire curriculum in 3 parts – theory discussion, visualisations in excel, practical implementation through hands-on session in excel & python

Ans.4. To get certificates you need to complete all topic wise assignments, master project and pass the Final exam.

Ans.5. You can take either 1 year access or lifetime access. Please note that lifetime access is chargeable extra

Ans.6 With this website we have integrated a customized P2T player that will allow you to play encrypted classes. There are no limitations on the number of views. Also the software is compatible with Windows, Mac, Android or iPhone

Ans.7. To interact with the trainer we have a dedicated forum ‘D-forum’. Any questions asked on D-forum are expected to be replied within 24 hours by trainers and team of moderators & experts.

Ans. 8. Presently we are conducting exams in Aug mid and Jan mid. You can choose any of the cohort. In case you are not able to pass the exam in one go, you can re-book at a nominal charge

Ans.9. Every class is supported by One note files, Excel sheets & Python notebooks, Assignments and Quizzes, all these are available in the course section only.

Ans. 10. You get Letter of Recommendation physically delivered to you within 60 days of passing the exam. LOR’s also mention the chosen specialisation with the project details.